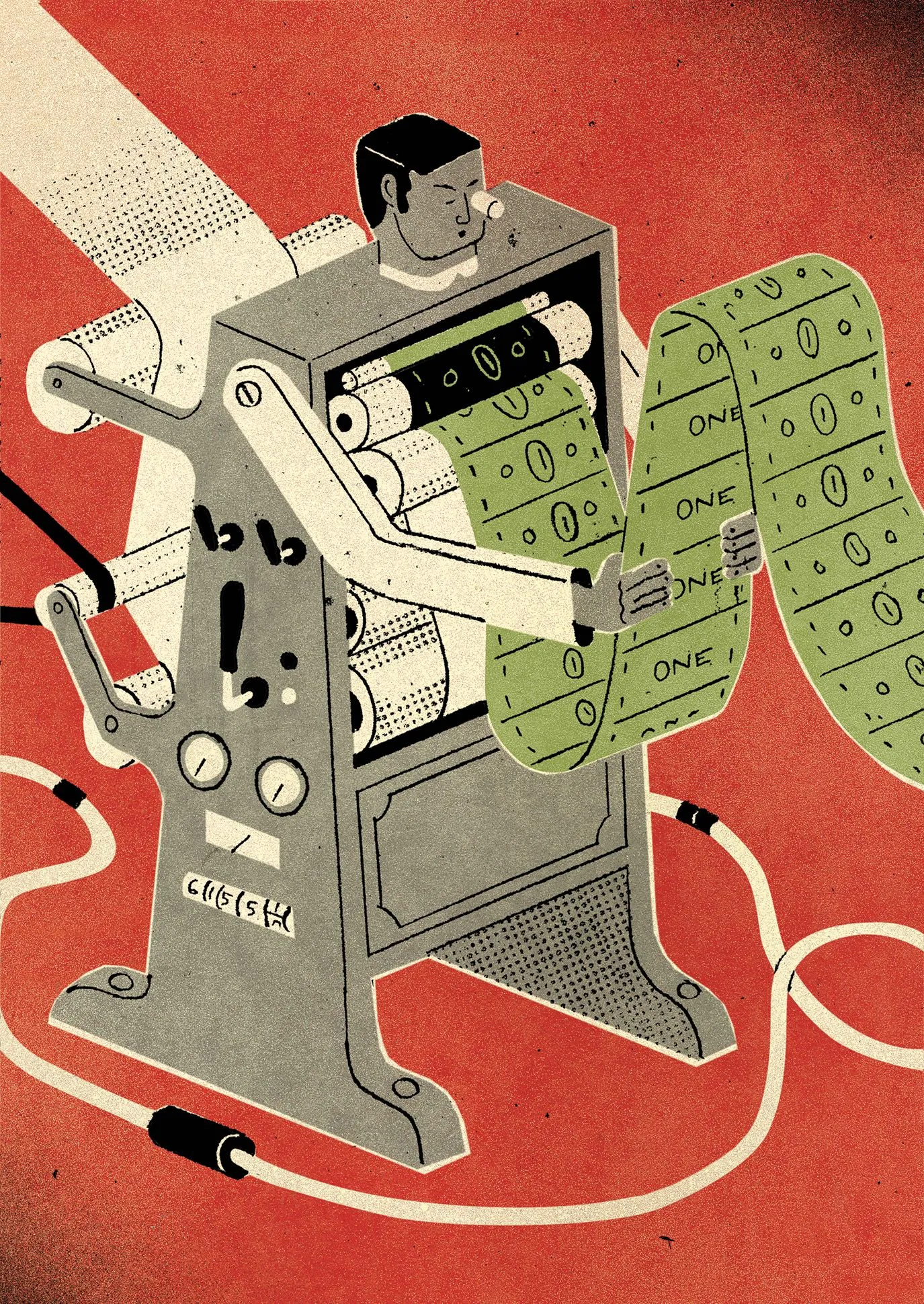

The Triumph of Printing Money

Europe has a great future in the devaluation and impoverishment of citizens

The illusionary triumph of printing money has become a cornerstone of modern economic policies, particularly in Europe, where central banks have embraced quantitative easing to sustain economies drowning in debt and inefficiencies. However, this strategy has birthed severe consequences, devaluing the euro, straining social structures, and accelerating economic decay.

By printing money indiscriminately, European governments have effectively reduced the purchasing power of the euro. Inflation has surged, eroding the savings of the middle class while benefiting large corporations and financial markets. The illusion of economic recovery has done little to address systemic problems such as stagnant productivity and a lack of innovation. Instead, countries like Spain, Italy, and Greece continue to languish under the weight of crushing public debt.

Accompanying economic stagnation is a troubling social shift. The rise of “woke” ideologies, often championed by a performative “caviar left” or pseudo-progressive elite, has eroded traditional societal values. These movements prioritize divisive identity politics over addressing real social inequalities, creating a fragmented and disillusioned populace. This cultural shift distracts from critical issues such as economic reform and responsible governance.

Compounding Europe’s challenges is the issue of illegal immigration. While immigration can enrich societies, poorly managed influxes strain public services, exacerbate unemployment, and foster social tensions. In aging countries like Spain and Italy, where birth rates are among the lowest globally, the burden of supporting expansive welfare systems falls on a shrinking workforce. This dynamic threatens the sustainability of the welfare state as resources become increasingly stretched.

One glaring contrast lies in taxation policies. In Switzerland, entrepreneurs benefit from minimal tax burdens, encouraging innovation and investment. By contrast, countries like Spain impose punitive tax rates of up to 50% on individual incomes, coupled with a growing list of additional levies that basically can be around 70% of your income, and this is not a joke. This discourages entrepreneurship, drives talent abroad, and perpetuates economic stagnation. Excessive taxation feeds bloated bureaucracies rather than empowering citizens or fostering economic dynamism.

Europe’s current trajectory is unsustainable. Solutions lie in structural reforms, reducing government inefficiencies, incentivizing entrepreneurship, and creating fair immigration policies that balance compassion with practicality. Revitalizing the welfare state requires fiscal responsibility and policies that encourage economic growth rather than stifle it.

For Europe to thrive, it must abandon the illusion of success through printing money and address the root causes of its economic and social challenges. Lessons from countries like Switzerland demonstrate that fostering innovation and reducing bureaucratic burdens can pave the way for a prosperous, equitable future. Without decisive action, the triumph of printing money may prove to be a Pyrrhic victory, leaving behind a legacy of decline and discontent.