Lending Pools Definition

A Deep Dive into DeFi’s Building Blocks

The world of cryptocurrency and blockchain technology is constantly changing, and decentralized finance (DeFi) is at the forefront of this revolution. Lending pools, a foundational element of DeFi, are transforming the financial industry. This comprehensive guide will dissect lending pools, explaining what they are, how they function, and why they’re important.

In the realm of DeFi, a lending pool is a collection of funds powered by smart contracts. This pool allows users to lend and borrow cryptocurrencies without relying on traditional middlemen like banks. These pools typically hold a variety of cryptocurrencies and act as a source of liquidity within the DeFi ecosystem. You can learn more about smart contracts:

https://ethereum.org/en/smart-contracts/

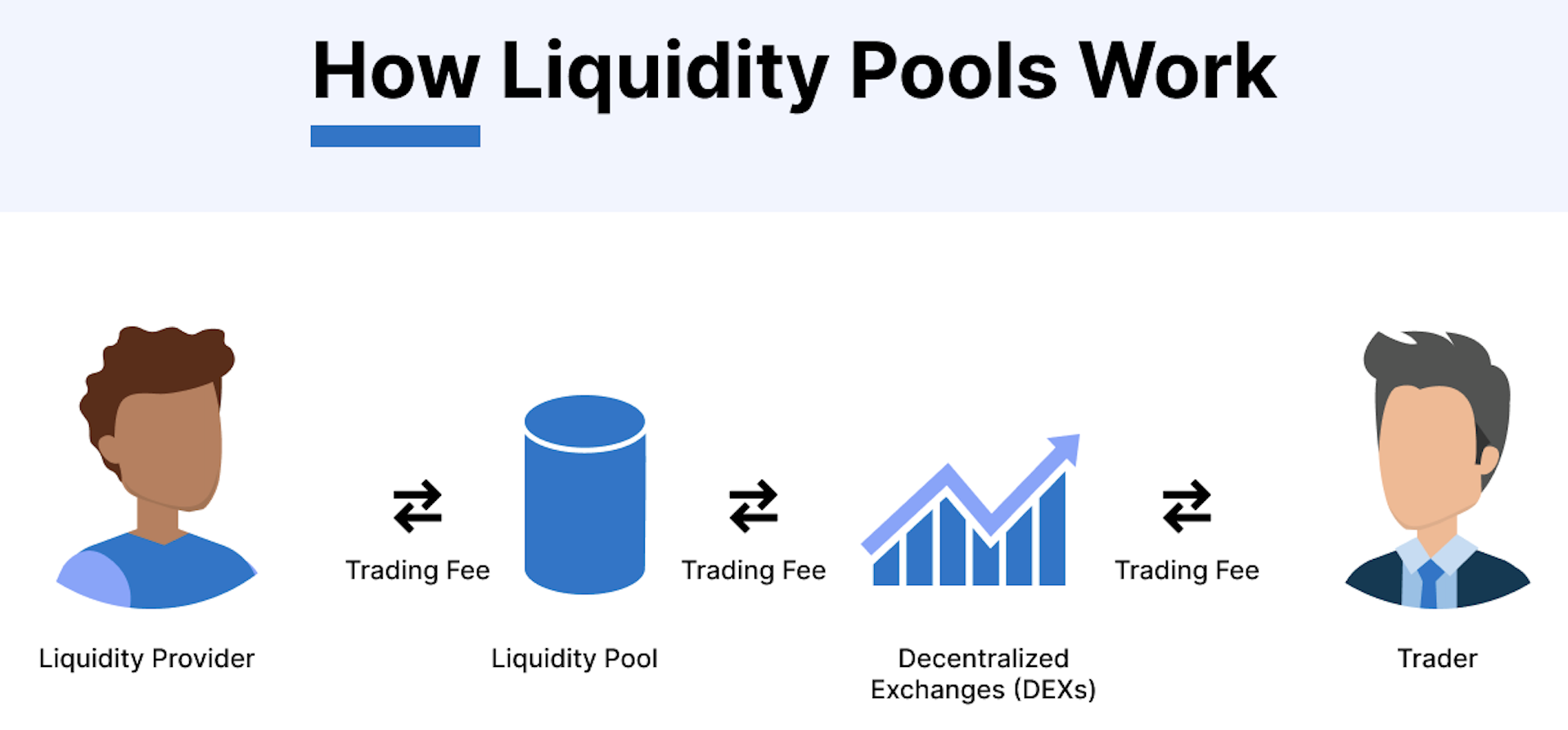

Lending pools function on blockchain platforms like Ethereum, using smart contracts to automate lending and borrowing processes. Users deposit their crypto assets into these pools, essentially becoming liquidity providers. These funds are then made available for borrowers who can access them by putting up their own assets as collateral.

People who contribute their crypto holdings to a lending pool are known as liquidity providers. They earn interest on their deposits and play a vital role in ensuring there are enough funds for borrowers.

Borrowers leverage the assets in the lending pool as security for loans. The amount they can borrow is determined by the value of the collateral they provide and the platform’s specific rules.

Interest rates in lending pools are fluid and can fluctuate based on supply and demand. When there are more borrowers using a pool, interest rates may rise to attract additional liquidity providers. Conversely, an abundance of liquidity can lead to lower interest rates.

Lending pools democratize access to financial services. Anyone with an internet connection can participate, regardless of their location or background. This inclusivity is a significant departure from traditional banking systems.

Smart contracts govern lending pools, eliminating the need for intermediaries. This reduces costs, speeds up transactions, and enhances transparency. Users can verify all transactions directly on the blockchain. You can learn more about blockchain technology

https://www.investopedia.com/blockchain-4689765

Liquidity providers can earn passive income through interest generated by the lending pool. This has attracted many participants, as it offers an alternative to traditional savings accounts with potentially higher returns.

While lending pools offer numerous advantages, they also come with risks. The decentralized nature of DeFi can expose users to vulnerabilities in smart contracts, impermanent loss, and market volatility. It’s crucial to conduct thorough research and exercise caution when participating in DeFi activities.

Lending pools are constantly evolving, with innovations like algorithmic stablecoins, flash loans, and yield farming creating new possibilities in the DeFi space. As blockchain technology progresses and DeFi projects mature, lending pools are likely to play an even more prominent role in the global financial landscape.

Lending pools are a cornerstone of decentralized finance, representing a significant shift away from traditional banking systems. They empower individuals to access financial services, earn passive income, and participate in a transparent and efficient ecosystem. While challenges and risks exist, the potential for innovation and growth in the DeFi lending pool space is substantial. As the DeFi landscape continues to evolve, lending pools are poised to be a driving force in reshaping the future of finance.