Ethena USDe (USDE), A New Era in Synthetic Stablecoins

Innovative solutions

The cryptocurrency market has long sought a truly decentralized and innovative stablecoin solution. Ethena USDe (USDE) is emerging as a game-changer in the industry, offering a unique approach to stability, collateralization, and yield generation. Developed by Ethena Labs, this synthetic dollar stablecoin introduces an advanced financial mechanism that goes beyond conventional stablecoins like USDT or USDC.

https://app.ethena.fi/

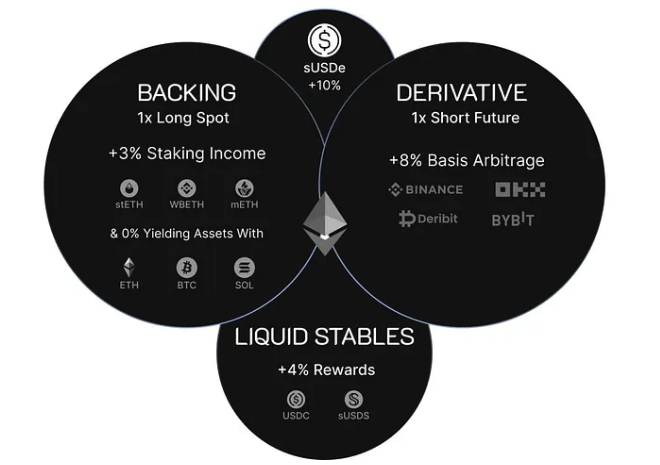

Ethena USDe (USDE) is a synthetic dollar-pegged stablecoin built on Ethereum that employs a delta hedging strategy using ETH as collateral to maintain its dollar value. Unlike traditional stablecoins, which rely on fiat reserves or other stable assets, USDE uses hedging mechanisms to neutralize market risks, making it one of the most innovative stablecoin projects in the market.

USDE’s peg is maintained through delta hedging, a strategy widely used in traditional finance to offset potential price movements of the underlying asset. In this case, USDE achieves stability by:

- Using ETH as Collateral: Instead of being backed by fiat reserves, USDE is collateralized by ETH, with its exposure managed dynamically.

- Delta Hedging: This mechanism involves taking offsetting short positions on ETH derivatives, ensuring that the stablecoin maintains its peg even if the price of ETH fluctuates.

- Automated Risk Management: The protocol continuously adjusts its positions to counteract volatility and market conditions.

One of the key differentiators of Ethena USDe is the introduction of the Internet Bond, a new financial instrument designed to generate yield for stablecoin holders. This allows users to earn returns on their USDE holdings, unlike traditional stablecoins that simply act as a store of value.

How the Internet Bond Works:

- USDE holders can stake their assets to access yield generated from delta-neutral strategies.

- Hedged positions on ETH derivatives ensure that capital remains stable while producing returns.

- Users receive rewards based on market conditions, making USDE not just a stablecoin but a yield-bearing asset.

This concept could revolutionize decentralized finance (DeFi) by providing users with a stable, reliable, and profitable asset class that competes with traditional bonds or fiat-based stablecoin yields.

Ethena Labs has attracted significant backing from top investors, solidifying its credibility in the crypto space. The project’s strategic partnerships and investment rounds demonstrate confidence in its model and long-term viability.

Why Ethena USDe Stands Out:

- Truly Decentralized: Unlike fiat-backed stablecoins, USDE does not rely on centralized banking reserves.

- Hedge Against Volatility: The delta hedging strategy minimizes risk exposure.

- Yield-Generating: The Internet Bond feature makes USDE not just a store of value but an income-generating asset.

- Built on Ethereum: Leveraging Ethereum’s security and liquidity, USDE benefits from deep DeFi integration.

Ethena USDe (USDE) represents a new frontier in stablecoins by combining decentralization, stability, and yield generation. With its innovative delta hedging mechanism and Internet Bond concept, USDE could reshape the way crypto users interact with stable assets.

As DeFi continues to evolve, projects like Ethena USDe are paving the way for a more resilient, sustainable, and profitable financial ecosystem.

Disclaimer:

The information provided in this article is for informational and educational purposes only and should not be considered financial, investment, or legal advice. Cryptocurrency investments and trading involve significant risk, and past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. Ethena USDe and related financial instruments are subject to market risks, regulatory changes, and volatility. The author and publisher are not responsible for any financial losses incurred from actions taken based on this article.