Exploring the Most Famous dApps

The Rise of Decentralized Applications

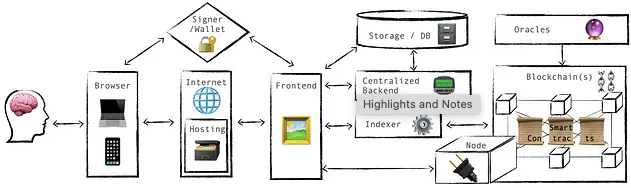

The world of blockchain technology has grown exponentially over the past decade, and at its core are Decentralized Applications (dApps), which are revolutionizing industries like finance, gaming, and digital art. Unlike traditional applications, dApps run on decentralized networks such as Ethereum, Binance Smart Chain, and other blockchain platforms. They offer transparency, security, and, most importantly, remove intermediaries from crucial processes like trading, lending, and governance.

In this article, we explore some of the most famous dApps currently leading the decentralized revolution. These dApps are shaping the future of decentralized finance (DeFi), gaming, and more.

1. Uniswap (Ethereum)

Category: Decentralized Exchange (DEX)

Uniswap is the go-to decentralized exchange for trading Ethereum-based tokens. It allows users to swap ERC-20 tokens without relying on a centralized exchange. As a pioneer of the Automated Market Maker (AMM) model, Uniswap enables users to provide liquidity in exchange for trading fees. With its simplicity and seamless integration into the Ethereum ecosystem, Uniswap has become a key player in the DeFi movement.

• Key Feature: Liquidity pools and AMM model for token swaps.

• Why it’s popular: Easy-to-use interface and the ability to trade without a middleman.

2. Aave (Ethereum)

Category: DeFi Lending Protocol

Aave is a decentralized finance (DeFi) platform that allows users to lend and borrow cryptocurrencies. Borrowers can use their assets as collateral to secure loans, while lenders can earn interest by supplying liquidity. Aave introduced flash loans, a unique feature where loans are borrowed and repaid within the same transaction, providing advanced financial tools for traders and developers.

• Key Feature: Flash loans and flexible interest rates (stable or variable).

• Why it’s popular: Innovation in DeFi lending and borrowing.

3. Compound (Ethereum)

Category: DeFi Lending Protocol

Compound is another top player in the DeFi space, providing a decentralized lending platform where users can deposit assets into liquidity pools to earn interest or use their collateral to borrow. Compound’s algorithmic interest rates are automatically adjusted based on supply and demand, making it a dynamic and efficient solution for decentralized finance.

• Key Feature: Algorithmic interest rates for efficient lending and borrowing.

• Why it’s popular: Simple interface and strong reputation in DeFi.

4. OpenSea (Ethereum)

Category: NFT Marketplace

OpenSea is the largest marketplace for Non-Fungible Tokens (NFTs), where users can buy, sell, and trade digital assets like art, collectibles, and even virtual real estate. With the explosion of interest in NFTs, OpenSea has become the primary platform for creators and collectors alike, enabling the trade of unique digital goods on the blockchain.

• Key Feature: A vast marketplace for NFTs ranging from digital art to domain names.

• Why it’s popular: Extensive catalog of NFTs and strong creator community.

5. PancakeSwap (Binance Smart Chain)

Category: Decentralized Exchange (DEX)

Built on Binance Smart Chain (BSC), PancakeSwap offers a fast and cost-effective alternative to Ethereum-based exchanges. Like Uniswap, it uses an AMM model but with significantly lower fees due to BSC’s faster transaction times and lower gas costs. It has become the go-to DEX for users seeking to trade BEP-20 tokens and engage in yield farming.

• Key Feature: Yield farming and token swaps with low gas fees.

• Why it’s popular: Lower transaction fees compared to Ethereum.

6. SushiSwap (Ethereum, Multichain)

Category: DEX and DeFi Platform

SushiSwap started as a fork of Uniswap but quickly evolved into a full-fledged DeFi platform. Beyond token swapping, SushiSwap now offers staking, yield farming, and lending services. It distinguishes itself with a strong emphasis on community governance and decentralized growth.

• Key Feature: Governance by its users via SUSHI tokens.

• Why it’s popular: Diverse DeFi features and strong community engagement.

7. Axie Infinity (Ethereum, Ronin)

Category: Play-to-Earn Game

Axie Infinity is a play-to-earn game where users collect, breed, and battle creatures called Axies. Players can earn Smooth Love Potion (SLP) tokens by playing, which can be traded on exchanges. Built on Ethereum and using the Ronin sidechain for scalability, Axie Infinity is a leader in blockchain-based gaming and digital ownership.

• Key Feature: Play-to-earn mechanics where players can earn real money.

• Why it’s popular: Engaging gameplay and the ability to earn through playing.

8. Curve Finance (Ethereum)

Category: DEX (Stablecoin-focused)

Curve Finance is a decentralized exchange optimized for stablecoin trading, offering low fees and low slippage due to its specialized AMM designed for stable assets. It is one of the most efficient ways to swap stablecoins like USDT, DAI, and USDC.

• Key Feature: Stablecoin trading with minimal slippage.

• Why it’s popular: Efficient for stablecoin swaps and liquidity provision.

9. MakerDAO (Ethereum)

Category: DeFi Lending and Stablecoin Protocol

MakerDAO is the platform behind DAI, a decentralized stablecoin pegged to the US dollar. Users can lock ETH or other assets as collateral to mint DAI, which is used in countless DeFi applications. MakerDAO was one of the earliest DeFi platforms and remains essential for decentralized lending and stability in the DeFi space.

• Key Feature: Creation of the DAI stablecoin.

• Why it’s popular: Stablecoin solution trusted across DeFi applications.

10. Decentraland (Ethereum)

Category: Virtual World

Decentraland is a decentralized virtual world where users can buy, sell, and build on virtual land parcels represented as NFTs. The platform has its own cryptocurrency, MANA, which is used to purchase land and goods within the virtual ecosystem. Decentraland is pioneering the concept of decentralized metaverses where users have full ownership of in-game assets.

• Key Feature: Virtual real estate and user-generated content.

• Why it’s popular: Innovative approach to virtual worlds and metaverse applications.

11. Synthetix (Ethereum)

Category: DeFi Derivatives Platform

Synthetix is a platform for creating and trading synthetic assets that represent real-world financial assets like stocks, commodities, and other cryptocurrencies. These synthetic assets, called Synths, are traded in a decentralized manner, allowing users to gain exposure to real-world markets without leaving the blockchain.

• Key Feature: Trading of synthetic assets tied to real-world values.

• Why it’s popular: Expands DeFi into traditional asset markets.

12. 1inch (Multichain: Ethereum, BSC, Polygon)

Category: DEX Aggregator

1inch is a decentralized exchange aggregator that finds the best prices across multiple DEXs to optimize trades for users. By splitting trades across various liquidity pools, 1inch ensures the best rates and lowest slippage for token swaps.

• Key Feature: Optimizes trades for the best prices across multiple DEXs.

• Why it’s popular: Convenient for users looking to maximize efficiency in DeFi trades.

13. The Sandbox (Ethereum)

Category: Virtual World/Game

The Sandbox is a decentralized virtual world where users can create and monetize their own gaming experiences. Using NFTs, users own virtual land, avatars, and other in-game items. The platform promotes a decentralized economy where users can earn by creating digital content.

• Key Feature: User-generated content and NFT-based virtual real estate.

• Why it’s popular: Combines gaming and blockchain in a metaverse setting.

14. Rarible (Ethereum)

Category: NFT Marketplace

Rarible is an NFT marketplace where creators can mint, sell, and trade NFTs. It distinguishes itself by offering a governance token, RARI, which gives users voting rights on the platform’s development. This community-driven approach has made Rarible a major player in the NFT space.

• Key Feature: Minting and selling NFTs with community governance.

• Why it’s popular: Emphasis on creator control and community-driven development.

15. QuickSwap (Polygon)

Category: DEX

QuickSwap is a decentralized exchange built on the Polygon network, providing users with a faster and cheaper alternative to Ethereum-based DEXs. It offers the same AMM model as Uniswap but with lower fees due to Polygon’s high throughput.

• Key Feature: Low gas fees and fast transaction speeds.

• Why it’s popular: Ideal for users looking to trade ERC-20 tokens with lower costs.

These dApps represent the future of decentralized finance, gaming, art, and more. From pioneering DEXs like Uniswap and PancakeSwap to innovative virtual worlds like Decentraland and The Sandbox, the decentralized ecosystem is growing rapidly. Each of these