Is It Time to Buy Stocks? Part 1

A 150-Year-Old Theory Suggests So

When it comes to understanding market cycles, investors often look to various analytical tools, but few may be aware of a theory dating back to the 19th century that still holds relevance today. This theory, developed by a humble pig farmer named Samuel Benner, has been guiding investors for over 150 years, offering a historical perspective on market patterns and potential buying opportunities.

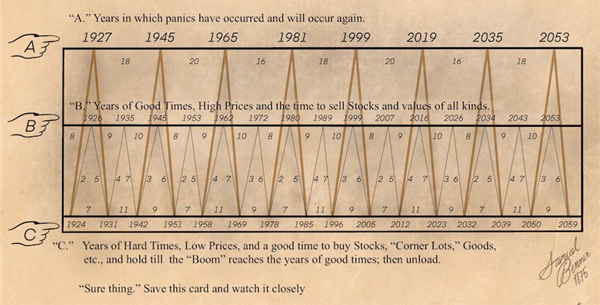

In 1875, Benner published his findings on the cyclical nature of asset prices. His theory is based on three distinct time sequences, predicting periods of prosperity, declines in commodity prices, and recessions. According to Benner, these cycles unfold over predictable time intervals, allowing investors to anticipate market highs and lows.

Benner’s model works on the following cycles:

- Prosperity Cycles: These occur every 16, 18, and 20 years, during which market conditions are ripe for growth and rising asset prices.

- Commodity Price Cycles: These declines follow patterns of 8, 9, and 10 years, signaling drops in the prices of essential goods like oil and raw materials.

- Recession Cycles: These downturns occur in patterns of 5, 6, and 7 years, marking periods of economic contraction and lower stock prices.

This simple yet profound theory has held up over time, proving useful for investors looking to identify when to sell or buy assets. The idea is that after a certain number of prosperous years, a downturn is inevitable, followed by a recovery and the next wave of growth.

How Benner’s Cycles Apply to Current Markets

Given the recent volatility in global markets, many investors are seeking guidance on when to buy back into stocks. If Benner’s theory holds, we may be approaching one of those ideal buying opportunities.

The recent global economic challenges, including inflationary pressures, interest rate hikes, and supply chain disruptions, suggest we could be nearing the end of a commodity price cycle, possibly creating a dip in asset prices that could align with Benner’s prediction of an upcoming recovery period. According to Benner’s time-tested sequences, the current downturn could give way to a prosperous phase in the stock market over the next few years, presenting an attractive entry point for investors.

The Relationship Between Bitcoin and Benner’s Market Cycles

One interesting dimension to consider is the potential relationship between Benner’s cycles and the rise of digital assets, particularly Bitcoin. While Bitcoin was introduced over a century after Benner’s theory, its market cycles share similarities with traditional asset classes. Bitcoin is known for its extreme price volatility, experiencing rapid booms followed by deep corrections, patterns not unlike those found in Benner’s commodity price cycles.

Bitcoin could follow these historical cycles of prosperity and recession. As global markets undergo significant transformations, particularly in technology and finance, Bitcoin is often viewed as a hedge against inflation and traditional financial market downturns. Investors may look at Benner’s theory not only for insights into traditional asset markets but also for guidance on how digital currencies like Bitcoin may behave.

For example, Bitcoin’s price tends to surge during periods of high inflation and economic uncertainty, which may align with Benner’s commodity price cycles. Furthermore, given Bitcoin’s decentralized nature and lack of correlation with specific economic policies, its movements could become more synchronized with broader financial cycles over time.

A Timeless Investment Strategy

Samuel Benner’s market cycle theory, though created over a century ago, continues to offer valuable insights into asset price movements. For those watching current markets and looking for signs of when to buy stocks, Benner’s historical patterns suggest that we may be nearing a favorable entry point. Additionally, with the rise of Bitcoin and other cryptocurrencies, it’s worth considering how this theory might apply to the digital asset space, offering investors a broader perspective on market timing.

Whether you’re a traditional investor in stocks or a modern enthusiast of cryptocurrencies, Benner’s time-tested principles could provide useful guidance for navigating the complex and ever-changing financial landscape.