Is It Time to Buy Stocks? Part 2

Navigating the Future of Markets with Benner’s Cycles

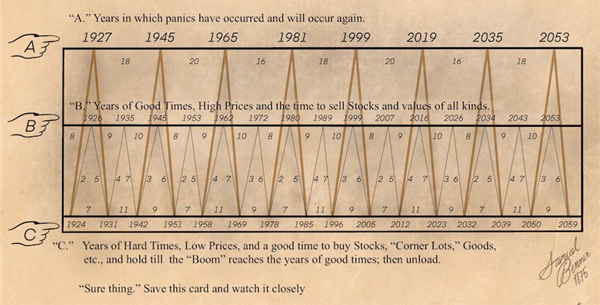

As we look ahead, the fundamental nature of financial markets, despite evolving technologies and digital assets, continues to be influenced by cycles of boom and bust. Samuel Benner’s theory, based on observations over 150 years ago, suggests that human behavior, driven by fear, greed, and reaction to economic forces, remains remarkably consistent. This is why historical cycles, like those described by Benner, continue to be relevant for modern investors.

Benner’s theory can offer a level of foresight, helping investors to avoid emotional, short-term reactions to market volatility. Instead, it encourages a long-term view of market movements. Recognizing that downturns are natural and often followed by periods of prosperity can provide a sense of patience and perspective, allowing investors to better time their entries and exits in the market.

Broader Implications: Technology, Cryptocurrencies, and New Market Dynamics

While Benner’s theory was developed in the context of traditional asset classes, it can also be applied to emerging technologies and the broader evolution of financial markets. Digital transformation, globalization, and the rise of decentralized finance (DeFi) are reshaping the landscape, but the underlying principles of market cycles remain intact.

Bitcoin and other cryptocurrencies represent a new frontier in asset classes, yet they follow some of the same cyclical patterns as traditional commodities and stocks. For instance, Bitcoin has experienced several boom-and-bust cycles since its inception, with rapid price surges followed by steep corrections. These cycles, often influenced by macroeconomic factors such as inflation fears or regulatory developments, can mirror Benner’s commodity price sequences.

If Benner’s patterns of commodity price cycles and recessions apply to Bitcoin, we might expect similar periods of high volatility followed by stabilization and growth. For instance, Bitcoin tends to rise in value during economic uncertainty, as investors seek alternatives to traditional fiat currencies. This rise could correlate with Benner’s theory of periodic commodity price hikes, suggesting that Bitcoin could experience bullish periods during these cycles.

However, it’s important to consider that digital assets also present new risks. Cryptocurrency markets are still young and more vulnerable to external shocks, regulatory changes, and technology-driven disruptions compared to traditional stocks and commodities. Investors might use Benner’s cyclical framework as one tool among many in predicting Bitcoin’s market behavior but should also consider the unique factors influencing the digital asset space.

What Should Investors Do?

For traditional stock market investors, Benner’s theory suggests now may be an opportune time to start positioning for future gains. As the current economic downturn, driven by inflationary pressures and geopolitical uncertainties, seems to be aligning with Benner’s predicted cycle lows, investors might consider this a strategic buying opportunity.

For cryptocurrency enthusiasts, especially those invested in Bitcoin, Benner’s model could serve as a lens through which to view the broader macroeconomic environment. While Bitcoin’s cycles might not align perfectly with traditional asset cycles, there are signs that its price movements could increasingly reflect global market dynamics as it matures and garners broader institutional adoption.

Combining Historical Wisdom with Modern Strategies

Samuel Benner’s theory provides a compelling framework for understanding market movements over long periods, offering investors a roadmap to navigate through times of uncertainty. While markets and technology have advanced significantly since Benner’s time, the human factors driving market cycles, fear, optimism, over-exuberance, and correction, remain unchanged.

Incorporating Benner’s insights with modern investment strategies could help investors manage risk while capitalizing on market opportunities. Whether one is focusing on traditional equities, commodities, or digital currencies like Bitcoin, recognizing the cyclical nature of markets can help guide more informed and strategic decisions.

By blending historical analysis with current market data and emerging technologies, investors can develop a more robust understanding of where markets might be headed, ultimately positioning themselves to take advantage of long-term growth while mitigating risks during downturns.

While the financial markets are constantly evolving, the cyclical patterns identified by Samuel Benner over 150 years ago continue to offer valuable guidance.

As the global economy moves through cycles of expansion, contraction, and recovery, both traditional and modern asset classes, whether stocks or cryptocurrencies like Bitcoin, could be influenced by these timeless market rhythms. For those willing to take a long-term view, Benner’s cycles offer a reminder that after every downturn, the next period of prosperity awaits.