Navigating Decentralized Autonomous Organizations (DAOs) (Again)

Understanding Potential Risks and Considerations

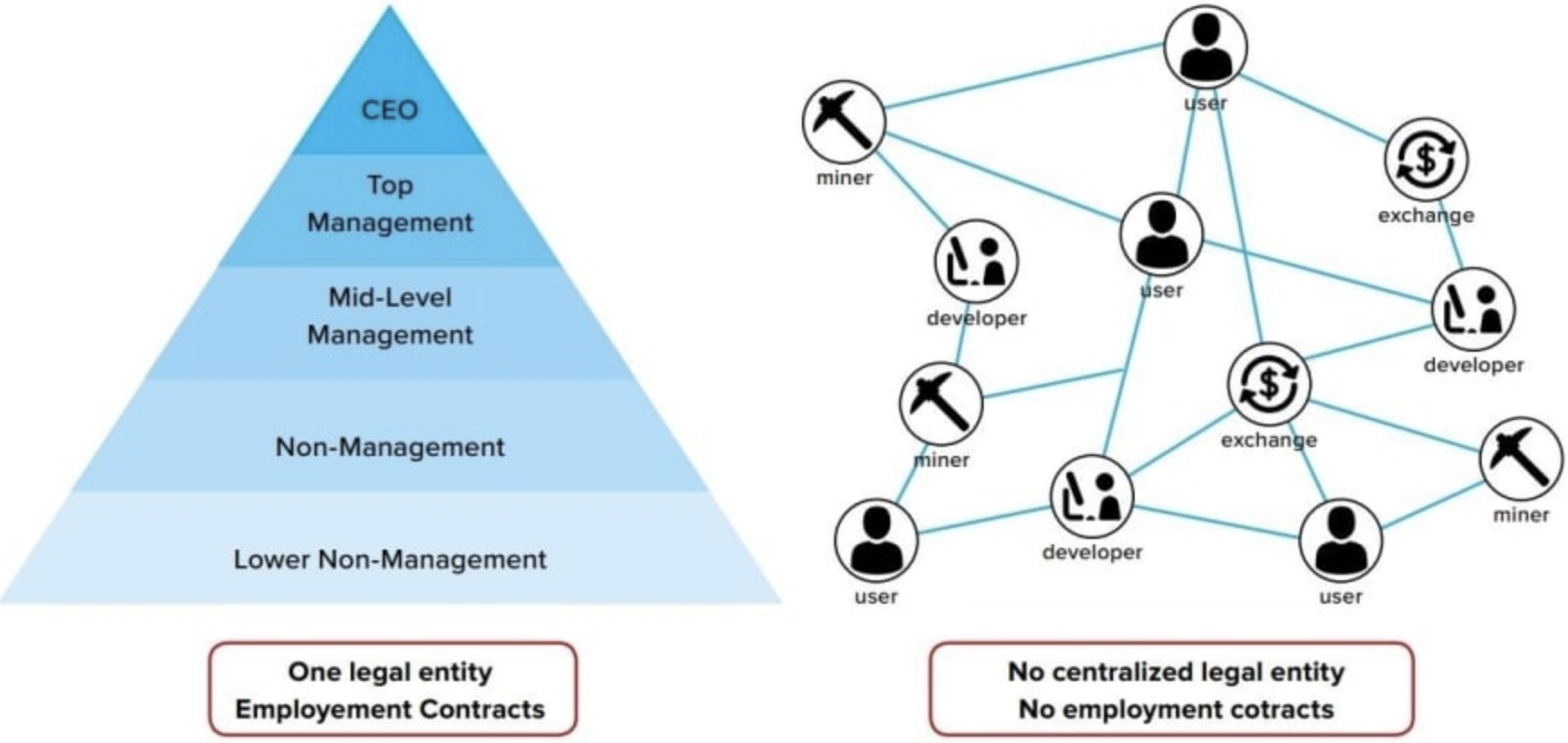

Decentralized Autonomous Organizations (DAOs) have emerged as a cornerstone of the decentralized finance (DeFi) landscape, offering users opportunities to participate in governance and yield-generating activities. However, navigating the risks associated with DAO involvement requires careful consideration of various factors. Here, we delve into some prominent DAOs and essential risk mitigation strategies.

Here, we are going to showcase the most important Decentralized Autonomous Organizations (DAOs) or, to be more precise, list some of the most interesting projects.

- Aragon: Aragon distinguishes itself by prioritizing decentralized governance processes over direct yields. Users engage in decision-making within Aragon organizations, fostering transparency and inclusivity. While this model reduces certain risks, users must be vigilant in understanding governance dynamics and potential conflicts.

https://aragon.org/

- MakerDAO: MakerDAO, the force behind the stablecoin Dai, doesn’t directly offer APY. Yet, users can earn yield by engaging in DeFi activities using Dai. These returns are subject to market fluctuations and the specific strategies employed, necessitating thorough risk assessment and diversification.

https://makerdao.com/en/

- Curve DAO: Curve Finance facilitates stablecoin trading with yield opportunities for liquidity providers. APY on Curve typically ranges from 3% to 10%, varying based on factors like pool composition and trading volumes. Users should monitor market conditions and potential impermanent loss risks inherent in liquidity provision.

https://dao.curve.fi/

- Yearn Finance: Yearn Finance optimizes yield farming strategies across DeFi protocols, offering APY ranging from 5% to 20%. Users benefit from automated asset allocation but must stay informed about underlying protocol risks and performance fluctuations.

https://yearn.fi/

- Balancer: Balancer’s automated portfolio management pools offer APY between 5% to 30% through trading fees and token rewards. While lucrative, users should assess factors like pool composition and token volatility, mitigating risks associated with impermanent loss and market fluctuations.

https://balancer.fi/

When assessing DAOs, several risk mitigation strategies prove invaluable:

- Transparency: Prioritize DAOs with transparent operations and governance structures, allowing stakeholders to audit activities effectively.

- Proven Track Record: Trust DAOs with a history of reliable governance decisions and community trust, indicating a lower risk of mismanagement.

- Robust Governance: Evaluate governance mechanisms to ensure inclusivity, fairness, and effective dispute resolution.

- Security Measures: Seek DAOs with robust security measures, including smart contract audits and emergency response plans.

- Community Engagement: Engage with DAOs fostering active community involvement, enhancing decentralization and decision-making resilience.

- Legal Compliance: Verify DAO compliance with relevant regulations, reducing regulatory risks and legal challenges.

- Decentralization: Favor DAOs distributing power among diverse stakeholders, mitigating centralization risks and potential manipulation.

- Risk Management: Assess DAO risk management strategies, including diversification and contingency plans, bolstering resilience to unforeseen challenges.

While DAOs present lucrative opportunities, thorough risk assessment and adherence to risk mitigation strategies are paramount. By understanding potential risks and embracing proactive risk management, participants can navigate the evolving DeFi landscape with confidence and resilience.